The worst of the global financial crisis may have passed, but could a sovereign debt crisis follow in its wake? This tale of two crises is still to play out, according to the World Bank’s Carlos Braga.

In times of economic crisis, debt burdens can become unsustainable, even at the sovereign level. Debt management is key in order to avoid potential crises.

At a recent presentation of a review of the World Bank and International Monetary Fund’s joint Debt Sustainability Framework, Mr Braga, Director Economic Policy and Debt Department of the World Bank, stressed the importance of debt monitoring and debt management in the coming months as the world economy absorbs the full impact of the 2008/ 2009 global financial crisis.

“Debt relief is no guarantee of debt sustainability,” said Mr Braga. “Overall we remain optimistic with respect to HIPCs [Heavily Indebted Poor Countries] but it is very important to monitor closely the position not only of the HIPC countries, but for developing income countries in general.

To listen to a short interveiw with Mr Braga, click on the icon below.

Carlos Braga, Director Economic Policy and Debt Department of the World Bank

Many of the world’s poorest countries received debt relief under the HIPC initiative in recent years. However, that debt relief does not protect low income countries from debt-related problems in the wake of the worst global financial crisis since the 1929 Great Depression, according to Mr Braga.

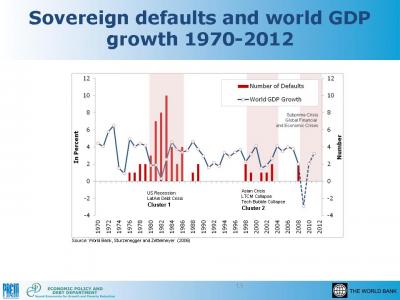

A significant concern is the risk of sovereign defaults – when a national government declares itself insolvent and unable to meet debt repayments. There were a rash of sovereign defaults following the US recession of the 1980s and the Asian crisis of the late 1990s. See graph, below (taken from Mr Braga's presentation).

So far, among developing countries, only Ecuador in South America and Seychelles, the island nation in the Indian Ocean, have defaulted on their sovereign debt since the onset of the latest global financial crisis.

One explanation for this low default rate is the current record-low level of interest rates. But with many forecasters predicting interest rate hikes in the coming years and many low income countries amassing larger short-term debts – a potential sign of trouble ahead, says Mr Braga - lenders and financial institutions need to plan accordingly.

Debt management is important for prevention of debt crises. In November 2008, the Bank launched a multi-donor trust fund, the Debt Management Facility for Low-Income Countries. The Facility aims at supporting LICs in improving their debt management (through a newly developed assessment tool referred to as DeMPA) and in developing Medium-Term Debt Strategies using a tool jointly developed by the World Bank and IMF. To find out more, click here: http://go.worldbank.org/7NY5H2N800.

Maintaining debt sustainability is also a prerequisite to achieving the poverty reduction targets of the Millennium Development Goals and promoting economic growth.

The World Bank and IMF’s joint debt sustainability framework (DSF) aims to support low-income countries in achieving their development goals without creating future debt problems. The DSF seeks to keep countries that have received assistance through the HIPC and the Multi-lateral Debt Relief Initiative (MDRI) on a sustainable track.

In essence, the DSF is the tool used by the Bank and IMF when assessing countries’ debt vulnerability and enables donors, lenders and borrows to make better informed decisions on debt.

In place since 2005, the DSF has been criticised for being too pro-cyclical and restricting financing needed to meet countries’ development goals, as expressed in the Millennium Development Goals. The recent review seeks to address those concerns by making the DSF tool more flexible in this post-financial crisis period. To find out more about the DSF visit: www.worldbank.org/debt

To see Mr Braga's presentation in full, click here.

Log in with your EU Login account to post or comment on the platform.