2015 Joint report on multilateral development banks’ climate finance

Discussion details

2015 marked the convergence of major global climate, development, and disaster risk management milestones which chart a more sustainable global future. These include: the adoption of the Sendai Framework for Disaster Risk Reduction (2015-2030) that aims to achieve substantial reduction of disaster risks and losses; the Addis Ababa Action Agenda, which provides a foundation for implementing the global sustainable development agenda and calls on developed countries to implement their commitments to the goal of mobilizing USD 100 billion of climate finance per year for developing countries by 2020; and the adoption of a set of 17 Sustainable Development Goals that aims to end poverty, protect the planet, and ensure prosperity for all. These milestones have set the tone for how institutions like the multilateral development banks (MDBs)—including the African Development Bank (AfDB), the Asian Development Bank (ADB), the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB), the Inter-American Development Bank Group (IDBG), and the World Bank Group (WBG)— prioritize their actions and operate in their client countries.

Climate Finance

The Paris Agreement, which was negotiated by representatives of 195 countries and was unanimously adopted in December 2015, is a major breakthrough by the international community in resolving climate change. This is the first climate change agreement that includes commitments by all signatories, in the form of Nationally Determined Contributions. Countries have committed to undertake actions or achieve domestic targets with a view of holding the increase in global average temperature to below 2 degrees Celsius, and pursue efforts to limit it to 1.5 degrees Celsius. Countries also plan to increase their ability to adapt to adverse impacts of climate change, and foster climate change resilience. Many developing countries stress that climate finance is vital to their ability to fully deliver on their contributions and increase their level of ambition over time. For the MDBs, the Paris Agreement becomes the foundation for their contribution to efficient and effective low-carbon and climate-resilient development.

Climate finance from a variety of sources plays an important role in mobilizing support for the Paris Agreement. MDBs are one important channel to support adaptation and mitigation actions in developing countries and emerging economies, together with other public development institutions deploying limited public sources of finance, and private sources of finance. All MDBs announced new ambitious multi-year targets in late 2015 to rapidly expand climate finance activities, adding to the momentum leading up to the Paris Agreement. The MDBs are scaling up related activities to strengthen policy, build institutional capacity, provide access to finance, and deliver technical support to client countries and their private sectors. The Paris Agreement notes that a progression beyond previous efforts is needed for finance flows to support a pathway towards climate change resilience and low greenhouse gas emissions development. This report highlights the important role of the MDBs in furthering these goals.

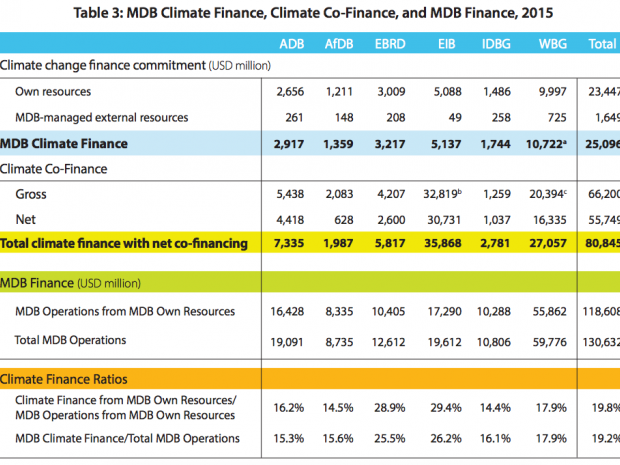

In 2015, the MDBs collectively committed more than USD 25 billion in climate finance, and have financed more than USD 131 billion in climate action in aggregate since 2011. As a group, the MDBs have been applying jointly developed methodologies for climate finance accounting, adding transparency to efforts to track global development finance flows that deliver climate co-benefits. In 2015, Common Principles for tracking mitigation and adaptation activities were developed together with the International Development Finance Club (IDFC), and a set of guidelines was established and applied to set a common approach for reporting on climate co-financing flows that are invested alongside MDBs’ climate finance activities. The total climate co-finance committed in 2015 was more than USD 55 billion, giving a total when combined with the MDBs’ climate finance of over USD 80 billion.

To enable a successful transition to a low-carbon, climate-resilient global economy as envisaged in the Paris Agreement, massive amounts of climate finance must flow to support countries’ achievement of their Nationally Determined Contributions and other low-carbon and climate resilience activities. This fifth edition of the Joint Report on Multilateral Development Banks’ Climate Finance provides an overview of mitigation and adaptation finance in the context of the MDBs' strengthened commitment to work with clients, other development finance institutions, the private sector, and stakeholders to tackle climate challenge with targeted and innovative finance.

Download the report here: http://idbdocs.iadb.org/wsdocs/getdocument.aspx?docnum=40431476

Log in with your EU Login account to post or comment on the platform.