Linking Tax Payment to Gender Equality and Sustainable Development

News details

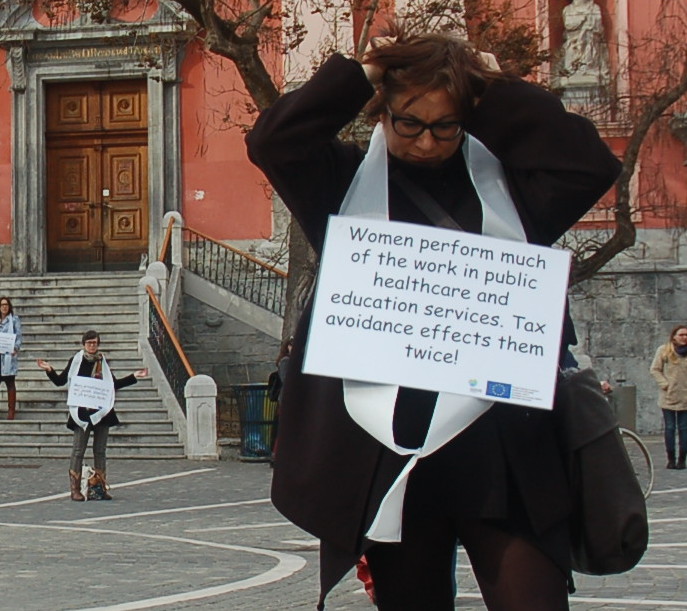

Passers by stop to look, read or exclaim at the placards draped around the necks of a group of campaigners for tax justice and women’s rights, one recent day in Slovenia's capital Ljubljana. As each campaigner strikes a pose to illustrate their slogan or represent how it makes them feel, some onlookers take the time to approach, and ask questions.

Katja Bozic is a 26-year-old hotel worker waiting for a friend in the square where the demonstration is taking place. While she waits, she reads the campaigners’ signs. “I didn’t know that women with children are most affected by unpaid tax!” she remarks, frowning she adds: “Ïf that [statement] is right, it’s wrong!”

Ms Bozic is just one of countless European Union citizens touched by the European Commission’s Development Education Awareness Raising Programme, or ‘DEAR’ for short. Every year the DEAR Programme works within EU Member States to inform people how they can make positive contributions to world development in their daily lives, in this instance by raising awareness on tax payment and gender equality.

Such actions are part of the Commission’s commitment to the internationally agreed Sustainable Development Goals and success in meeting those goals requires informed public engagement, according to Neven Mimica, Commissioner for International Cooperation and Development.

“Citizens must be conscious of their potential as actors of change, both individually and collectively,” said Mr Mimica, at a recent DEAR event. “The European Union needs this public engagement to be able to implement an ambitious development policy, but also – and maybe even more importantly – to help shape the future of Europe's relationship with the rest of the world.”

Tax Justice Together

In Slovenia, the DEAR programme is supporting global change by funding the ‘Tax Justice Together’ project through lead partner, ActionAid UK. Tax dodging at the personal and corporate level hinders development and fuels gender inequality according to ActionAid UK, which wants Europe to cut back on tax avoidance.

As part of Tax Justice Together, ActionAid UK works with 24 partners like Ekvilib Institut in Slovenia. From their bases across 19 countries, activists are campaigning for governments in Europe and the European Parliament to cut down on tax loopholes. Loopholes that are used by large multi-nationals and wealthy individuals to reduce their tax payments. The project says that such changes would increase government revenues everywhere, and especially in the developing world, where increased tax revenue could be used to pay for social services like schools, hospitals and infrastructure.

“There is a vicious cycle,” said Sandra Martinsone, Project Manager for Tax Justice Together at ActionAid UK. “On the one side we are giving money to the developing countries to develop. But from the other side we are maintaining a system that allows this massive flow of money out of the developing countries and therefore actually they are losing out, the balance is really negative.”

“And this is the part that we need to address, especially as European citizens here, that it’s a very hypocritical approach,” said Ms Martinsone. “You can’t with one hand give and with the other hand take much more back and then blame [developing countries] for not being competitive enough, strong enough or developed enough when you maintain a system that prevents that from happening.”

Taking a Different View

With guidance and inspiration from their fellow DEAR partners, Ekvilib Institute have staged a number of imaginative street actions and a theatre show on tax justice that ran for three consecutive nights in the city’s Glej Theatre.

“Talking about tax can be very dull,” said actress Katarina Stegnar who wrote and performed the one-woman tax play ‘Double Play’ to a full house every night. “It’s a big problem but it’s also a small problem. At the big level, we want companies to pay their taxes but at the small level perhaps we don’t want to pay taxes ourselves.”

This seeming contradiction of wanting to hold big corporations and wealthy individuals to account while many of us wilfully avoid tax by happily paying cash - to the plumber, the cleaner, the nanny - formed the crux of Ms Stegnar’s play. In Ljubljana, the message seems to have hit home.

“I understood the ‘Double Play’ in the title,” said Marusa Majer, 31, after the lights went up on Ms Regina’s final performance in the capital. “It made me think: What can I do? Where am I in this situation?”

|

DEAR supports knowledge, skills, policies, and behaviours that bring people together to act in the public interest, both at home in Europe and in the developing world. How did this project do that? Talking about tax can be a difficult subject, but as well as using street events and theatre the Tax Justice Together team used face-to-face meetings to share personal stories. ActionAid UK arranged for activists from developing countries to travel to Europe and explain, face-to-face with European audiences, how non-payment of tax at the global and local level negatively affects their lives, their countries and people in the developing world. For example, in November 2016, Ekvilib in Slovenia hosted Kenneth Kolo Kandiri from ActionAid’s offices in Nigeria to talk to Slovenians about the negative affects of tax evasion on development in his country Nigeria, which has the largest crude oil reserves in sub-Saharan Africa yet average life expectancy of just 52 years, loses billions of euros each year due to tax waivers and exemptions granted to multi-nationals and big corporations. Mr Kandiri’s visit to Slovenia, like others ActionAid UK organised, proved to be beneficial for both visitor and host. It raised awareness and critical understanding of our inter-connected and globalised society and encouraged Slovenians to consider how their lives are interconnected with neighbours in Europe, as well as people living much further way in the Global South. For Slovenian NGO Ekvilib Institut, working with an established campaigning organisation like Action Aid UK and being part of a team 24 partners from across Europe proved extremely fruitful. “We have a long history of demonstration [in Slovenia],” explained Marusa Babnik from Ekvilib Institut. “But campaigning and advocacy, approaching people in the street, that is new to us. We’ve really had to develop those skills - and we’re getting better at it.”

|

DISCLAIMER: This article has been written by the DEAR Support Team to provide information about a project that receives European Commission support via the DEAR Programme. The article should not be interpreted as the official view of the Commission, or any other organisation.

Log in with your EU Login account to post or comment on the platform.