Private finance

Private finance

Private investments are also a major amount, but these are not primarily seeking to fulfill public policy objectives. They calculated in the tables separately for domestic and international sources, however it may be better to treat the two aspects together here, because of the data overlaps/is difficult to separate and also the motivation for both domestic and international investments is similar.

Data sources

The Private Domestic Finance (Private Domestic Gross Capital Formation) should indicate the investments by private companies and individuals in the given year. It is calculated on the basis of private and total Gross Fixed Capital Formation:

- First, the ratio between Private Fixed Capital Formation and Public Fixed Capital Formation is applied to Gross Capital Formation to find a proxy for Private Gross Capital Formation.

- Second, FDI and Private non-guaranteed external debt are deducted from the private GCF, which gives an estimate for Domestic Private Gross Capital Formation.

Data are from the WB International Debt Statistics, except for FDI data from the WB WDI.

The Private International Finance puts together Foreign Direct Investment (FDI), Foreign Portfolio Investments, Remittances (from WB WDI), Private Non-guaranteed Debt (from WB IDS) and Private Charity (OECD DAC's Table 1).

Main issues

- Private Gross Capital Formation for OECD countries is not published and private domestic finance cannot be calculated. Therefore aggregates for these countries cannot be drawn. The OECD does publish the annual change in GCF, but the underlying data is not public.

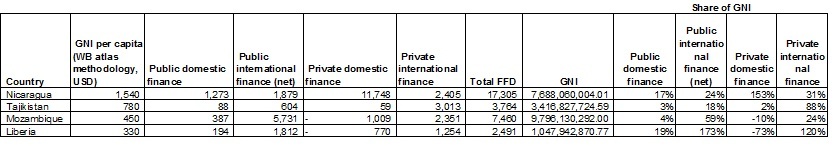

- The private domestic finance data has a downward bias due to the inconsistency of data from national accounts (WDI capital formation data) and balance of payment (WB IDS data on FDI), with the FDI exceeding in some cases the whole GCF which it should be a part of (see e.g. Liberia and Mozambique).

finance_data_-_examples_of_data_inconsistencies.jpg

- FDI and private debt data depend on the financing models companies use (reinvestments, profit-taking), which depend on the regulatory environment.

- For monitoring Private Finance, the full Private Gross Capital Formation may be a more relevant indicator, and the FDI data could be seen as a sub-indicator of international integration in that context.

- Private grants dataare in available to some extent by source countries, but not for recipient countries, as there is no comprehensive reporting platform for the private givers.

- The motivation of private grants and remittances are in general different from private investments.

Question

Are there better data sources or ways for calculating Private Finance?